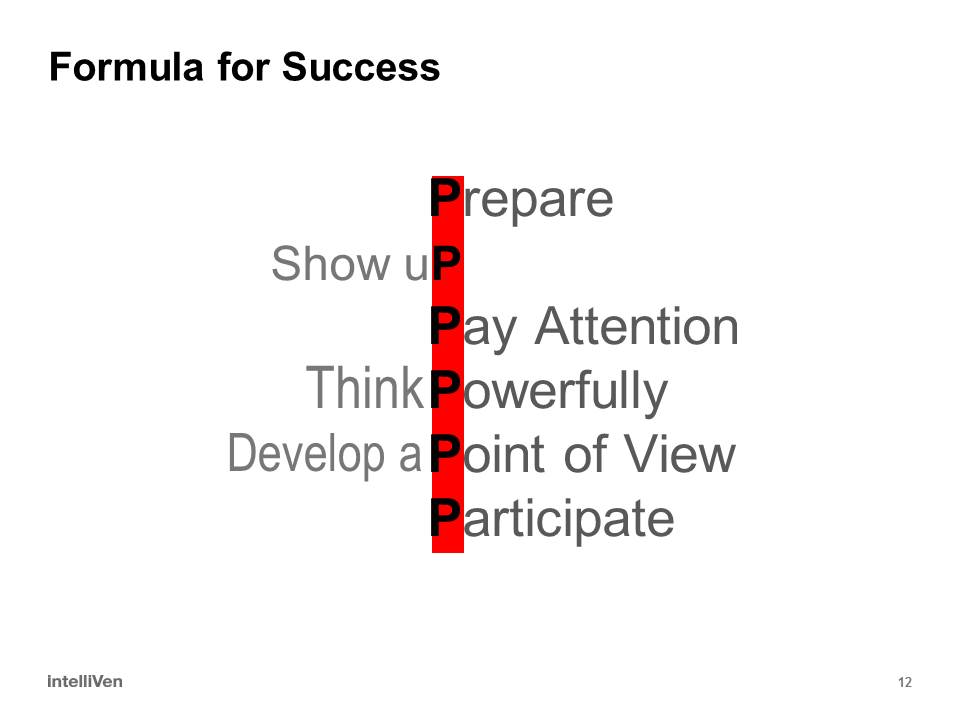

Transform the way you participate in board sessions, executive reviews, operating meetings, design and code walkthroughs, All Hands meetings, interviews, and more! Adopt the **Six Ps** for enhanced individual and group performance.

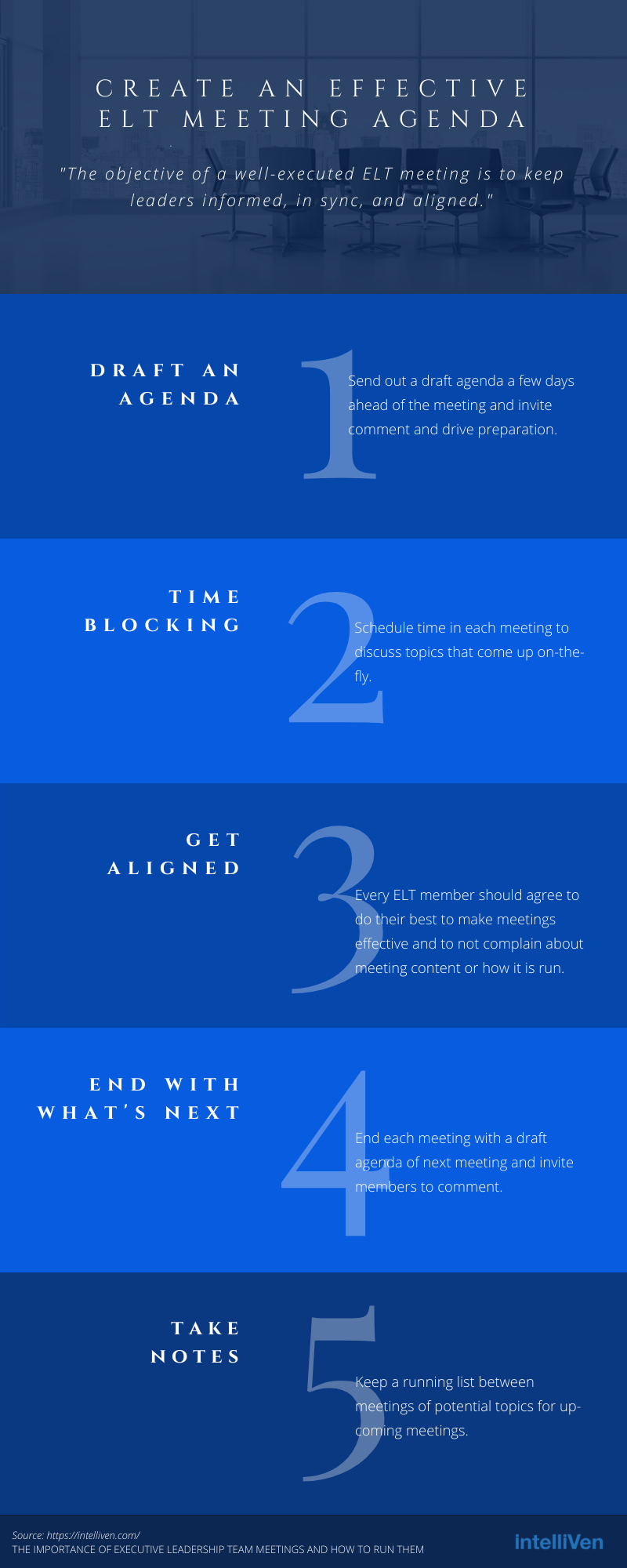

Prepare

Read materials sent in advance with enough lead-time to reflect on their content. If you are the meeting owner, make it easy for attendees to prepare, and for you and your team to step-back and develop perspective, by distributing background materials at least two days ahead.

Show uP

Attend! You cannot contribute if you do not attend both physically (even if electronically) and mentally. The most common reason meetings under-perform is that key participants, usually the most senior, are called away at the last minute to attend to urgent matters. There is no better formula for increasing the odds that the matter covered in the meeting they missed will someday cause its own urgency instead of smoothly performing to its highest potential.

Remember that all meetings start before they begin and end well after they are over. Those that come late and leave early may successfully convey how busy and important they are but at the high cost of missing more than they realize in terms of what they get, and what they could give, in order to ensure the best possible results.

Pay Attention

When someone talks: listen. Stay in-the-moment and concentrate to understand fully what is said. Do not allow your mind to wander, check for messages, or go on mute to simultaneously take another call or address other matters on the side.

Once a key thought or two have passed you by, it can be difficult to get back into the flow of what is being said. The more senior you are, the higher the stakes are to paying attention. Doing so ensures you will not waste the group’s time catching you up on what has already been covered when you re-engage and it is the only way to ensure that important opportunities to provide input and guidance are not missed.

To concentrate, it helps to write-down the exact words being said as they are spoken. Do not generalize, paraphrase, or add value; just write what you hear to stay focused. Another method is to play-back silently in your mind words spoken as they are heard. The objective is to hear and understand only what is said.

If what you hear does not make sense or otherwise leaves you with a question, check with the speaker to be sure you heard correctly. Chances are that if it helps you to check it out, it will help others as well. It also encourages the speaker to know they are being heard and listened to carefully.

Clarifying questions generally increase the odds that the group will reach a higher level of insight and understanding before offering recommendations, conclusions, or moving on to another point.

Think Powerfully

Give serious consideration to advance material, what is shared in the meeting, and what is said. Internalize, organize, and consolidate what you take in and compare with your own store of knowledge and prior experience to reach levels of insight and understanding that might help push the group’s work forward.

Develop a Point-of-View (PoV)

Push to go beyond taking in information and analyzing it in order to have a Point-of-View on the matter under discussion. If you need more information, ask for it. On the other hand, do not lock-in to a point-of-view too soon.

Be sure to listen to all sides, ask clarifying questions, think powerfully (i.e., critically), and then develop a Point-of-View. Both developing a PoV too soon and not developing a PoV at all, may signal laziness, lack of self-confidence, lesser ability (and that you may not belong in the meeting), and contribute to your own, and the group’s, under-performing.

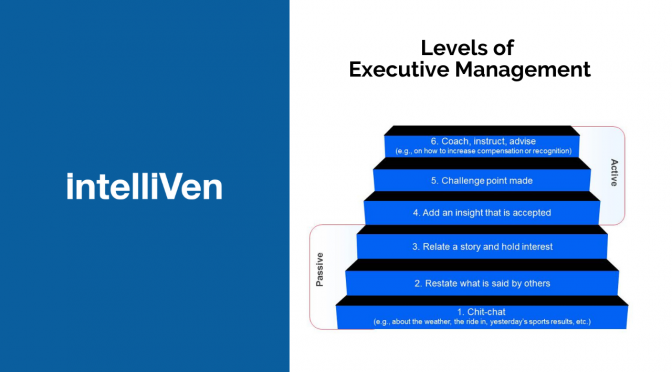

Participate

Don’t just sit there … say something! That said, it is not a good use of the group’s time for you to think out loud or to speak just to hear yourself talk. Speak once you have paid attention, asked good clarifying questions, thought powerfully, and developed a Point-of-View worth sharing. Before speaking, edit what you plan to say in order to speak efficiently and not take too much air-time.

There is a lot going on inside the head of every participant at every meeting. No one gets all this right every meeting but it helps to have a plan and a method to consciously follow. Helicopter-up from time to time to reflect on how things are going. If you are not engaged and participating then why are you there at all?

If you wonder how it is that someone like you could be in a position to contribute in such a forum, remember that the meeting organizer asked you to attend because they wanted your input and participation. Give yourself permission to be present and to participate fully. Try it, notice how it feels to participate, learn from the experience, and know that you will get better and find it easier and easier with practice.

Finally, push yourself to share what you have to say in the meeting and do not wait to whisper thoughts to one or two other attendees with whom you are most comfortable after the meeting ends and when it is too late for the group to benefit from what you have to share.

Conclusion: Make Every Meeting Count

Embrace these principles and notice the difference in your participation and the meeting’s outcome. Remember, your input is valued, so give yourself permission to be fully present and engaged.

Share your experiences and tips in the comments below!